Initiating Coverage | Cable

December 30, 2016

KEI Industries

BUY

CMP

`124

Wiring for growth

Target Price

`153

KEI Industries (KEI) is a cable manufacturing company and also engaged in

Investment Period

12 Months

Engineering, Procurement and Construction (EPC) business. It offers high and low

tension cables, control and instrumentation cables, house wires, stainless steel

Stock Info

wires, and high-technology specialty cables. Its manufacturing facilities are

located at Bhiwadi, Chopanki & Silvassa. Through export KEI is present in over 45

Sector

Cable

countries across the globe.

Market Cap (` cr)

969

Healthy order book indicates strong revenue visibility: KEI’s current order book

Net Debt (` cr)

492

stands at `3,233cr (`2,154cr from EPC segment, `667cr from Cable segment,

Beta

1.2

`200cr from EHV segment, `49cr from Substation and the balance from EPC L1

52 Week High / Low

140/86

business). Its order book grew by ~28% in the last 3 years on the back of order

Avg. Daily Volume

113,885

inflows from State Electricity Boards, Power grid, etc. This gives KEI, a revenue

visibility for the next 12-16 months.

Face Value (`)

2

BSE Sensex

26,366

Strengthening distribution network and higher ad Spend to increase B2C

business: KEI’s consistent effort to increase its retail business from 30% of revenue

Nifty

8,104

in FY16 to 40-45% of revenue in the next 2-3 years on the back of strengthening

Reuters Code

KEIN.BO

distribution network (currently 926 which is expect to increase 1500 by FY19) and

Bloomberg Code

KEII.IN

higher ad spend (increased from `2cr in FY13 to `7cr in FY16 and expected to spend).

Exports to continue its growth momentum: KEI’s exports (8% of revenue in FY16)

is expected to reach a level of ~14-15% in next two years on the back of higher

Shareholding Pattern (%)

order execution from current order book of ~`180cr and participation in various

Promoters

49.0

international tenders worth `500cr. We expect a strong ~26% growth CAGR over

MF / Banks / Indian Fls

18.6

FY2016-19 in exports.

FII / NRIs / OCBs

5.8

Interest cost as % of net sales to decline by 150bp over FY16-19: We expect the

Indian Public / Others

26.6

company’s interest cost to decline due to (1) full repayment of its `211cr term

loan in next 2-3 years and (2) marginally lower interest cost arising due to the

improvement in credit rating. While company may see some rise in its working

Abs.(%)

3m

1yr

3yr

capital requirement due to higher sales in EPC segment, the debt repayment and

low interest rate should offset the same. Due to this, we expect interest cost to

Sensex

(7.4)

0.7

24.0

decline as % of sales which will further result in better profitability.

KEI

4.1

4.1

958.4

Outlook and Valuation: We expect KEI to report net revenue CAGR of ~13% to

~`3,335cr over FY2016-19E mainly due to (a) higher order book execution in

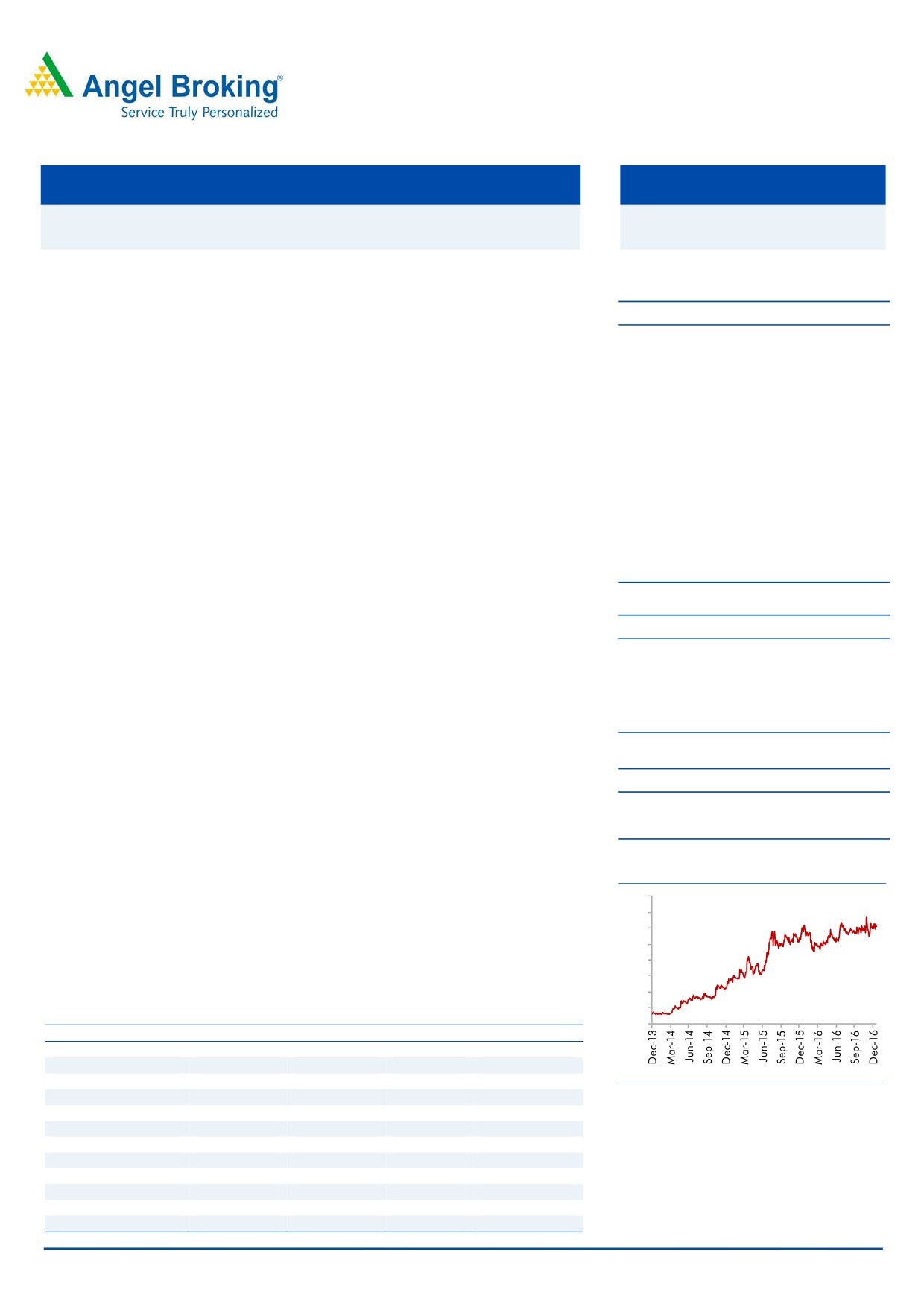

3-year price chart

EPC segment (b) growth in EHV business and (c) higher B2C sales and (d) higher

160

exports. On the bottom-line front, we expect a CAGR of ~24% to `118cr over the

140

same period on the back strong revenue and lower interest cost. At the CMP of

120

100

`124, the stock trades at 8.1x its FY2019E EPS of `15.3. We initiate coverage on

80

the stock with a Buy recommendation and target price of `153 based on 10x

60

FY2019E EPS, indicating an upside of ~23% from the current levels.

40

20

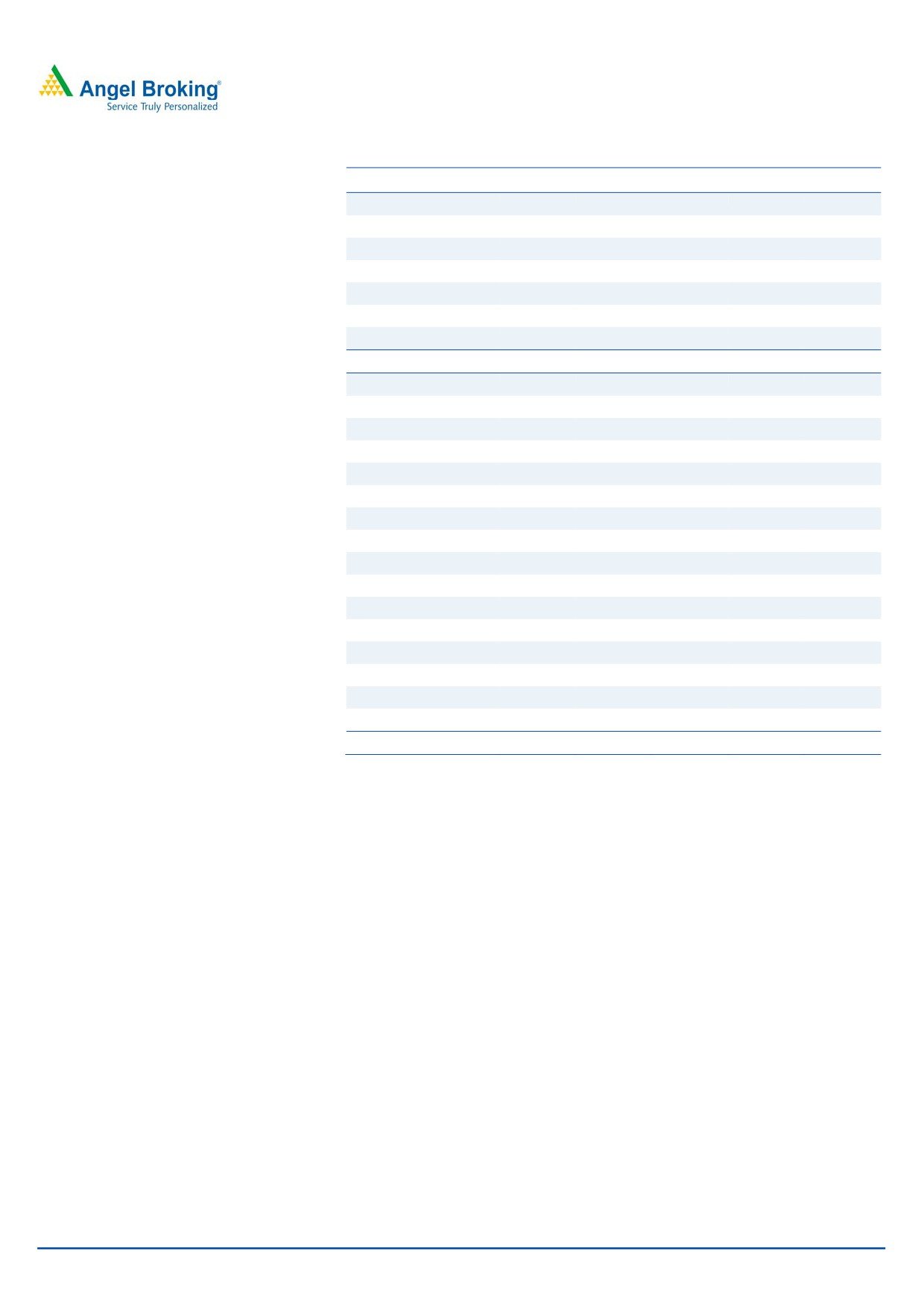

Key financials

0

Y/E March (` cr)

FY2016

FY2017E

FY2018E

FY2019E

Net sales

2,326

2,574

2,921

3,335

% chg

14.5

10.7

13.5

14.2

Net profit

62

78

91

118

Source: Company, Angel Research

% chg

91.0

25.4

17.1

29.0

EBITDA margin (%)

10.4

10.4

10.0

10.0

EPS (`)

8.1

10.1

11.8

15.3

P/E (x)

15.4

12.3

10.5

8.1

P/BV (x)

2.6

2.2

1.8

1.5

RoE (%)

17.0

17.7

17.4

18.6

RoCE (%)

25.1

24.2

24.5

25.5

Amarjeet S Maurya

EV/Sales (x)

0.6

0.6

0.5

0.4

022-39357800 Ext: 6831

EV/EBITDA (x)

6.0

5.6

5.1

4.5

Source: Company, Angel Research, Note: CMP as of December 29, 2016

Please refer to important disclosures at the end of this report

1

KEI Industries | Initiating Coverage

Key investment arguments

Top-line expected to grow by ~13% CAGR over FY16-19E

We expect the company to report a healthy revenue growth of ~13% over

FY16-19E on the back (1) strong order book leading to higher execution in EPC

segment (2) Huge opportunity in EHV segment (3) higher growth in exports.

Healthy order book indicates strong revenue visibility

KEI’s current order book stands at `3,233cr (`2,154cr from EPC segment, `667cr

from Cable segment, `200cr from EHV segment, `49cr from Substation and the

balance from EPC L1 business). Its order book grew by ~28% in the last 3 years

on the back of order inflows from State Electricity Boards, Power grid, etc. This

gives a revenue visibility for the next 12-16 months.

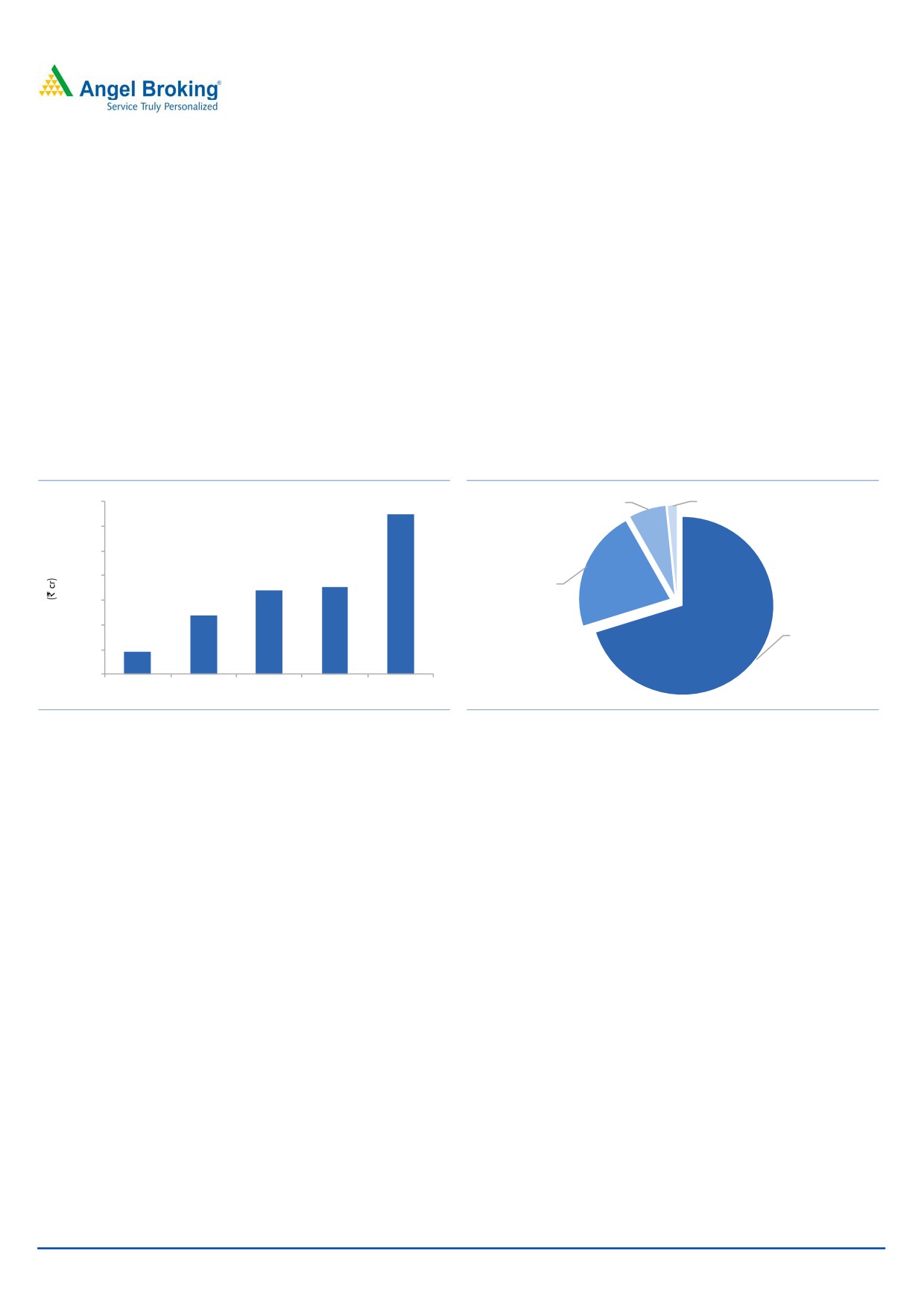

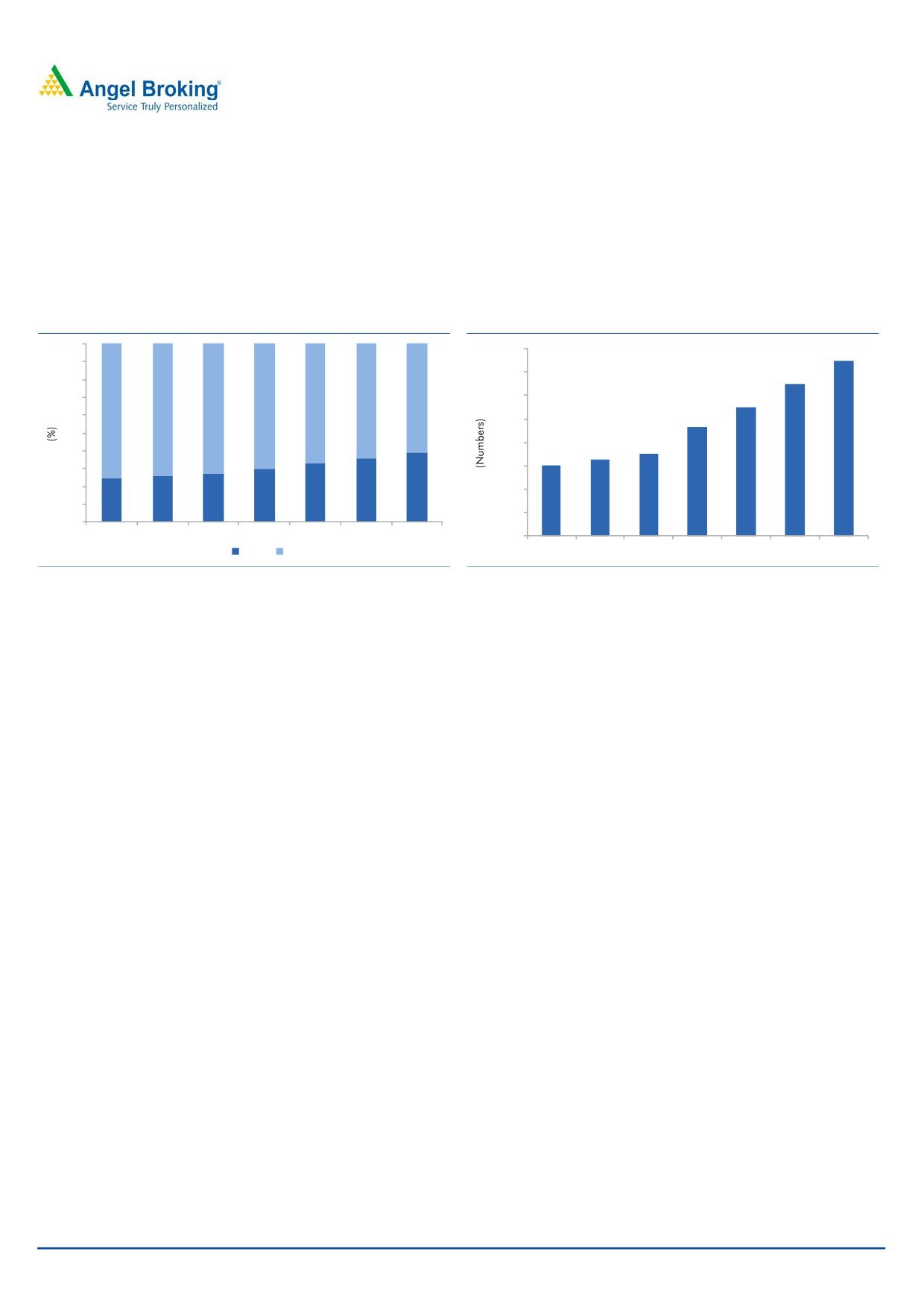

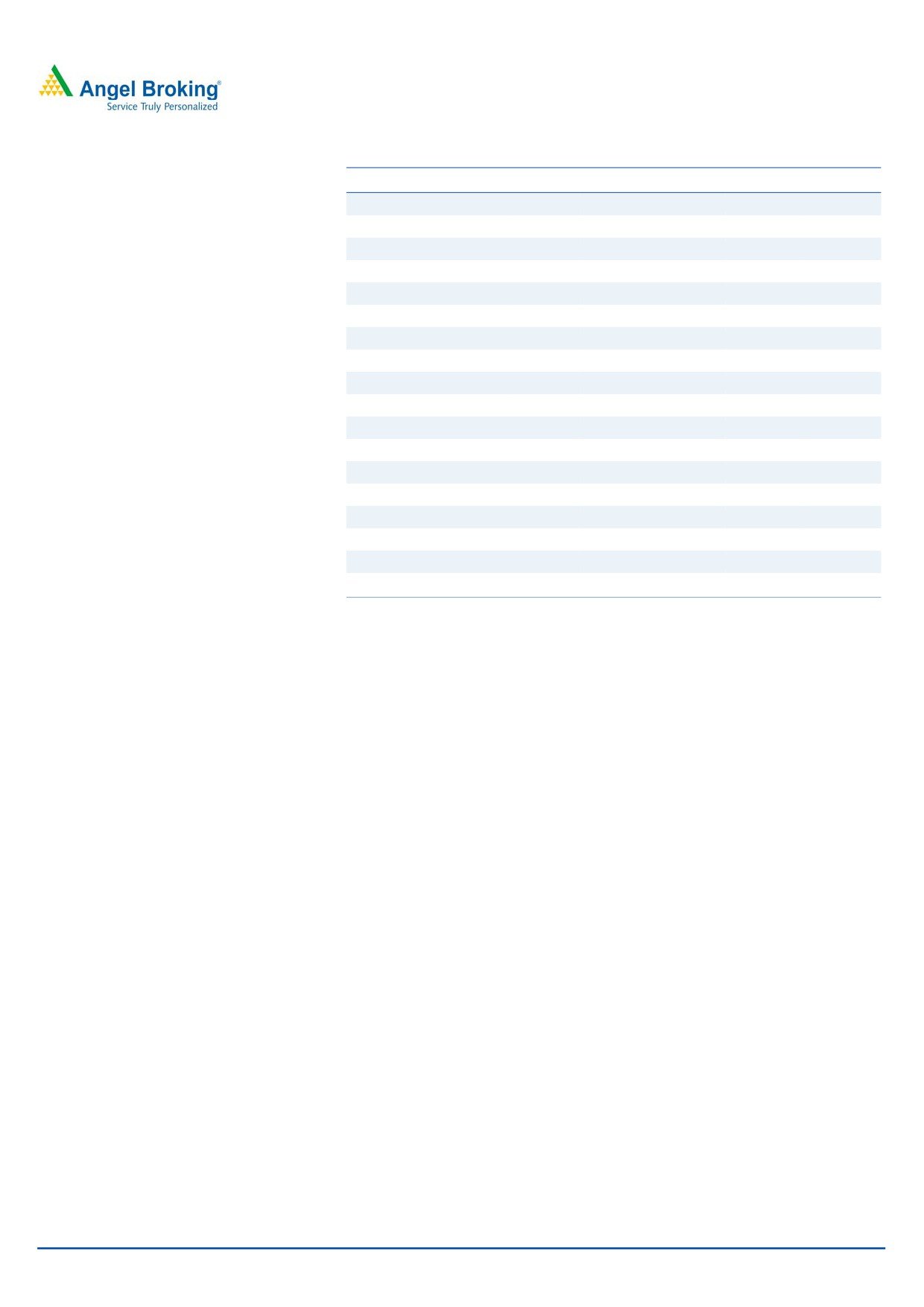

Exhibit 1: Oder book increased 1.8x from last year

Exhibit 2: Break-up of current order book

EHV, 6.5%

Substation,

3,500

3,233

1.6%

3,000

2,500

2,000

1,700

1,760

Cable, 21.7%

1,500

1,200

1,000

EPC, 70.2%

460

500

0

FY13

FY14

FY15

FY16

Current

Source: Company, Angel Research

Source: Company, Angel Research

Higher growth in EPC to boost the strong revenue growth

In the EPC segment, the main services offered by the company in the EPC segment

include execution of (1) Power transmission projects of 66kV to 400kV substations

on turnkey basis (2) EPC of EHV & HV cables systems (3) Electrical balance of plant

system for power plant (4) Electrical industrial projects etc.

KEI’s track record in key project execution is as below

EPC of HV Cablings system for JVVNL, Jaipur

MES for 100kV Transform and Electrical System of Air Force station, Gurgaon

Projects for power transmission utilities including projects for MSETCL, KSEB,

TNEB, RVPNL

Projects for Reliance Infrastructure (400kV switchyard for 2x600 mw Thermal

Power Project at Hissar

Industrial sector for AERENR, Ludhiana

Private utilities like Reliance, Tata Etc

Going forward, we expect that the company would report ~26% CAGR in EPC

revenue on back of higher order book execution. Currently the company’s order

December 30, 2016

2

KEI Industries | Initiating Coverage

book stands at ~`2,154cr which includes order inflow from the distribution

companies from UP.

The company has backward integration in terms of in-house cable manufacturing;

this provides KEI with an edge over its competitors as 25-30% of the total EPC

order cost goes in cables. KEI’s backward integration insulates its EBITDA margin

(10-11%) and we believe that this will sustain going forward.

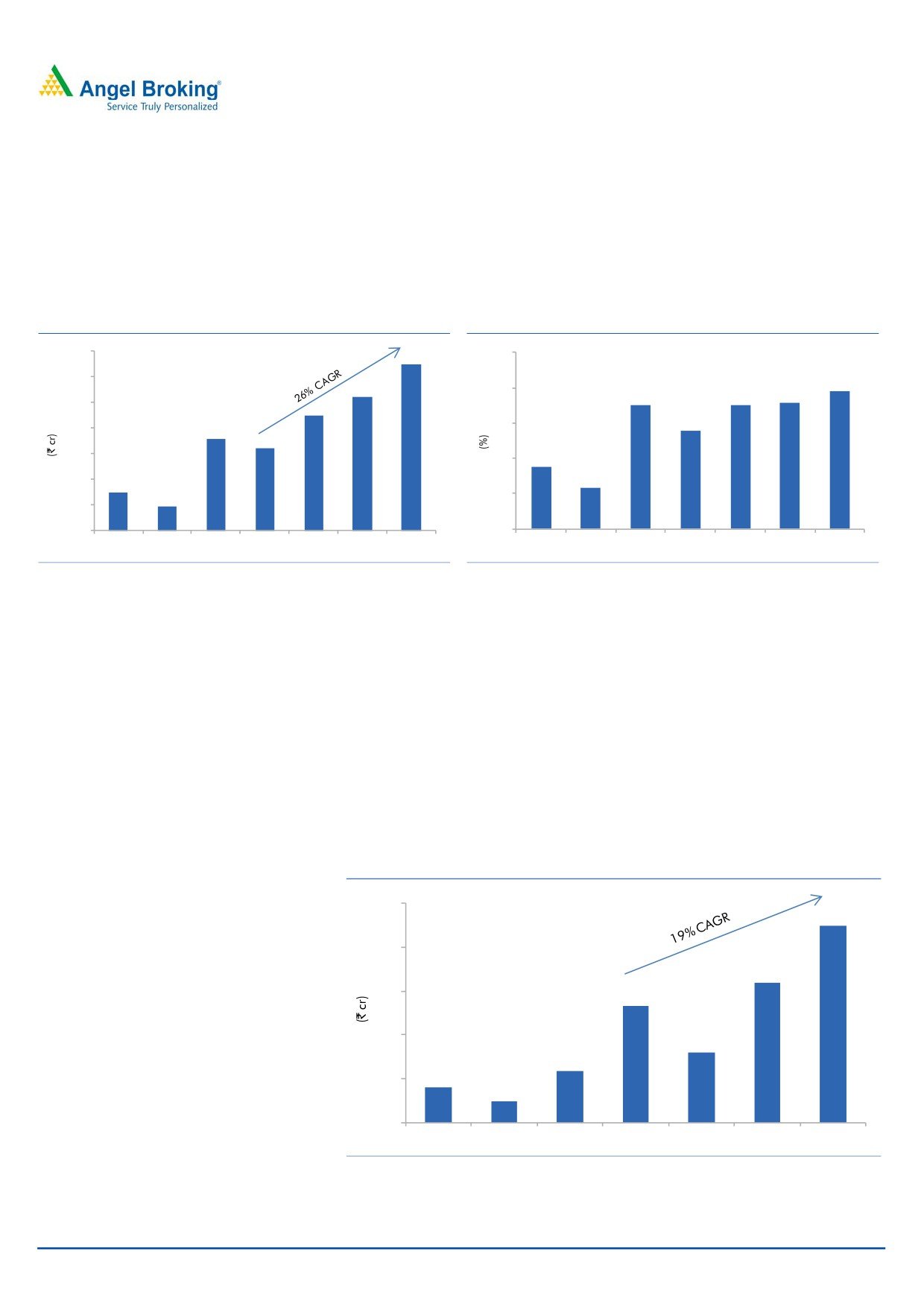

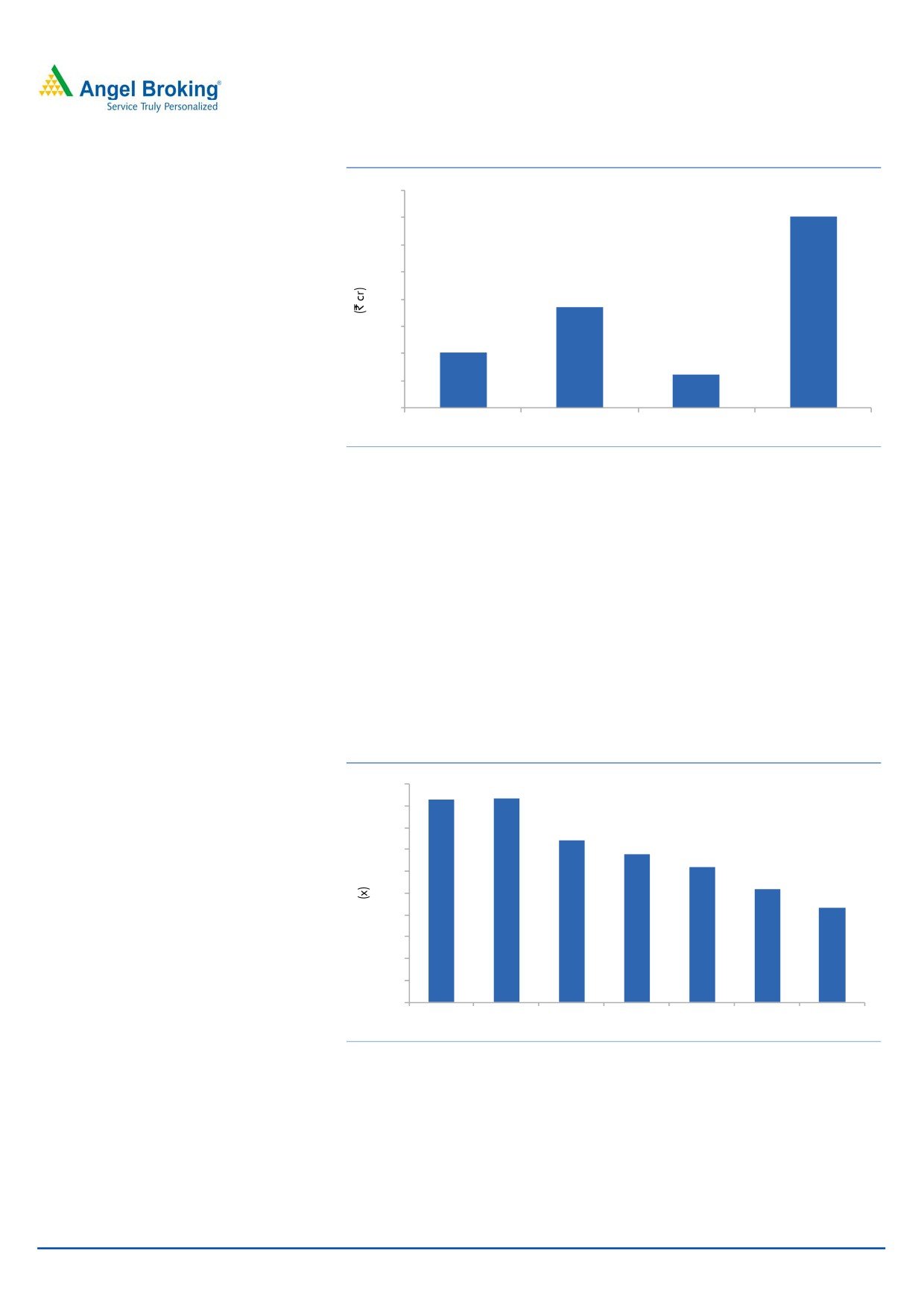

Exhibit 3: Strong growth expected in EPC segment

Exhibit 4: Revenue share of EPC business

700

25

600

19.5

20

17.8

17.6

17.5

500

13.9

15

400

8.9

300

10

5.8

200

5

100

0

0

FY2013

FY2014

FY2015

FY2016

FY2017E FY2018E FY2019E

FY2013

FY2014

FY2015

FY2016

FY2017E FY2018E FY2019E

Source: Company, Angel Research

Source: Company, Angel Research

Capacity expansion of EHV (Extra High Voltage) cable segment

to boost growth

KEI currently has an EHV cable manufacturing capacity of 700km ranging from

66kV upto 220kV for which it has a technical collaboration with Brugg Kabel AG,

Switzerland. To further increase its capacity in higher range, it has completed

`85cr capex, this includes manufacturing of EHV cables (upto 400KV) for 500km

capacity. The new capacity is expected to be operational by December-2016 and

has a potential to generate revenue of `250cr per annum. The company’s current

order book stands at `200cr. We expect EHV segment to report a CAGR of ~19%

over FY2016-FY2019E to `224cr.

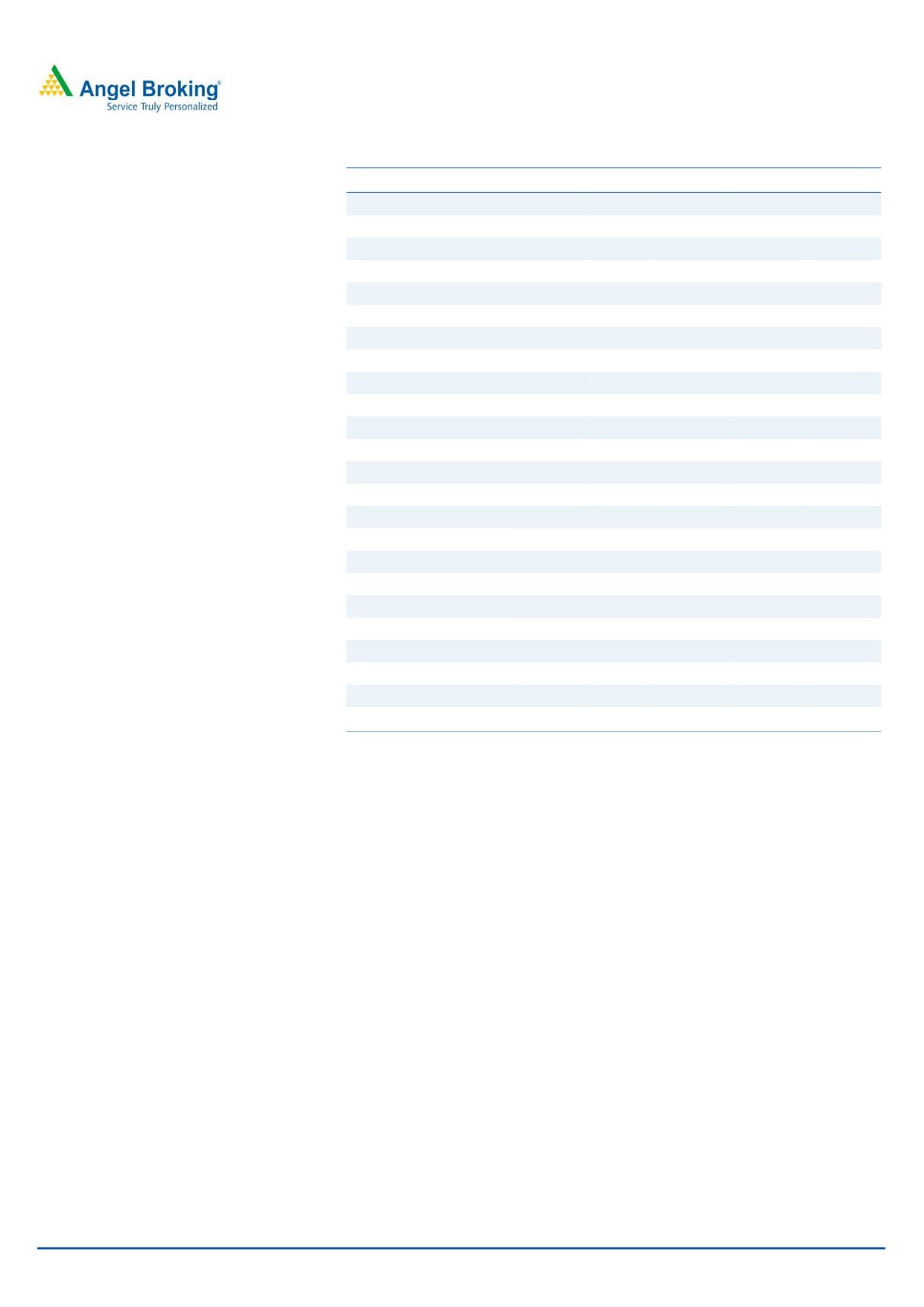

Exhibit 5: Capacity expansion to fuel EHV segment growth

250

224

200

160

150

133

100

80

59

39

50

24

0

FY2013

FY2014

FY2015

FY2016

FY2017E FY2018E FY2019E

Source: Company, Angel Research

December 30, 2016

3

KEI Industries | Initiating Coverage

Higher export growth to drive overall revenue

KEI exports its wide range of cables i.e. EHV (66kV to 220kV), MV (11kV to 66kV)

and LV (<11kV) to over 45 countries and operates in the export markets of UAE,

Singapore, Nigeria and Kazakhstan. It also has branch offices in Australia and

South Korea.

We are expecting the company to report a strong export CAGR of ~26% over

FY2016-19 on the back of order execution (current order book ~`150-180cr).

Further the company has participated in an international tender worth `500cr,

which is expected to add in order book. During 1HFY2017, the company has

already reported ~79% growth in revenue to `187cr.

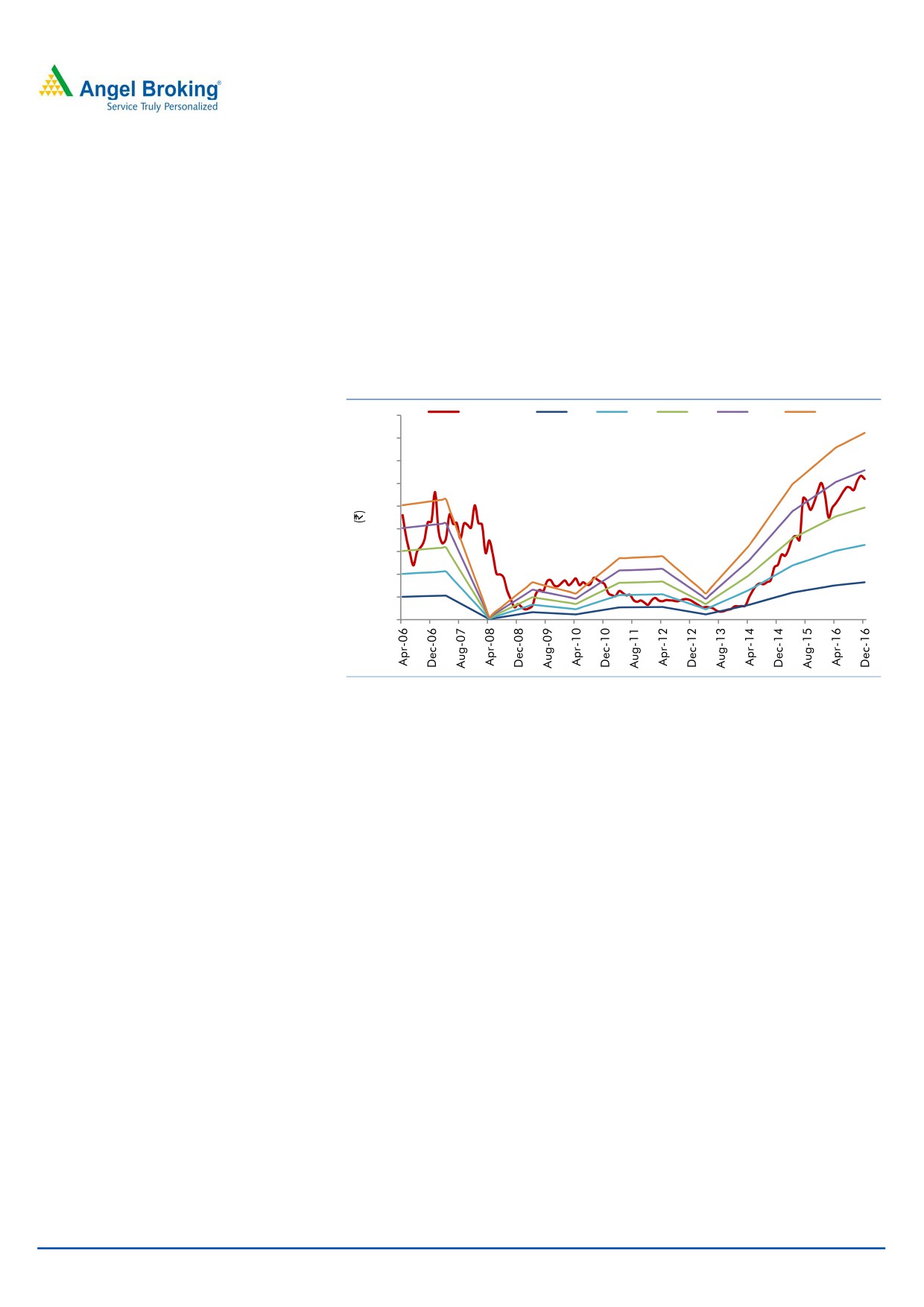

Exhibit 6: Exports to report 26% CAGR

500

450

400

431

350

385

344

300

250

200

198

191

150

147

100

97

50

0

FY2013

FY2014

FY2015

FY2016

FY2017E FY2018E FY2019E

Source: Company, Angel Research

December 30, 2016

4

KEI Industries | Initiating Coverage

Increased focus on Retail business

KEI has kept strong focus on growing its B2C revenue which can be clearly seen in

its improved business mix. In FY13 B2C represented ~25% of its total sales which

increased to ~30% in FY16. This is mainly on back of strong distribution network

and higher ad spends. Management continues to target higher B2C sales and

expects it to reach to 40-45% level in the next 2-3 years.

Exhibit 7: B2C vs B2B revenue mix

Exhibit 8: Enhancing dealer network

100

1,600

1,500

90

1,400

1,300

80

70

1,200

1,100

67

64

61

75

74

73

70

60

926

1,000

50

800

700

650

40

601

30

600

20

36

39

400

30

33

25

26

27

10

200

0

FY2013

FY2014

FY2015

FY2016

FY2017E

FY2018E FY2019E

0

B2B

B2C

FY2013

FY2014

FY2015

FY2016

FY2017E FY2018E FY2019E

Source: Company, Angel Research

Source: Company, Angel Research

Strengthening Distribution Network to boost retail growth

KEI is aggressively adding dealers and distributors across the country, especially in

tier 1 and tier 2 cities. It has increased its distribution channels from 601 in

FY2013 to 926 in FY2016 and is further planning to add 150-200 dealers every

year going forward. Owing to this, company has seen strong traction in its B2C

revenue.

Higher ad spends to increase brand visibility

In order to increase B2C business, the company has increased their ad spends in

last four years which increased from `2cr in FY13 to `7cr in FY16. Further, the

company has also taken other initiatives such as sponsoring IPL team - Kings XI

Punjab, association with regional exhibitions held by reputable bodies,

participation in international award events in the Middle East, South East Asia and

Europe, etc.

December 30, 2016

5

KEI Industries | Initiating Coverage

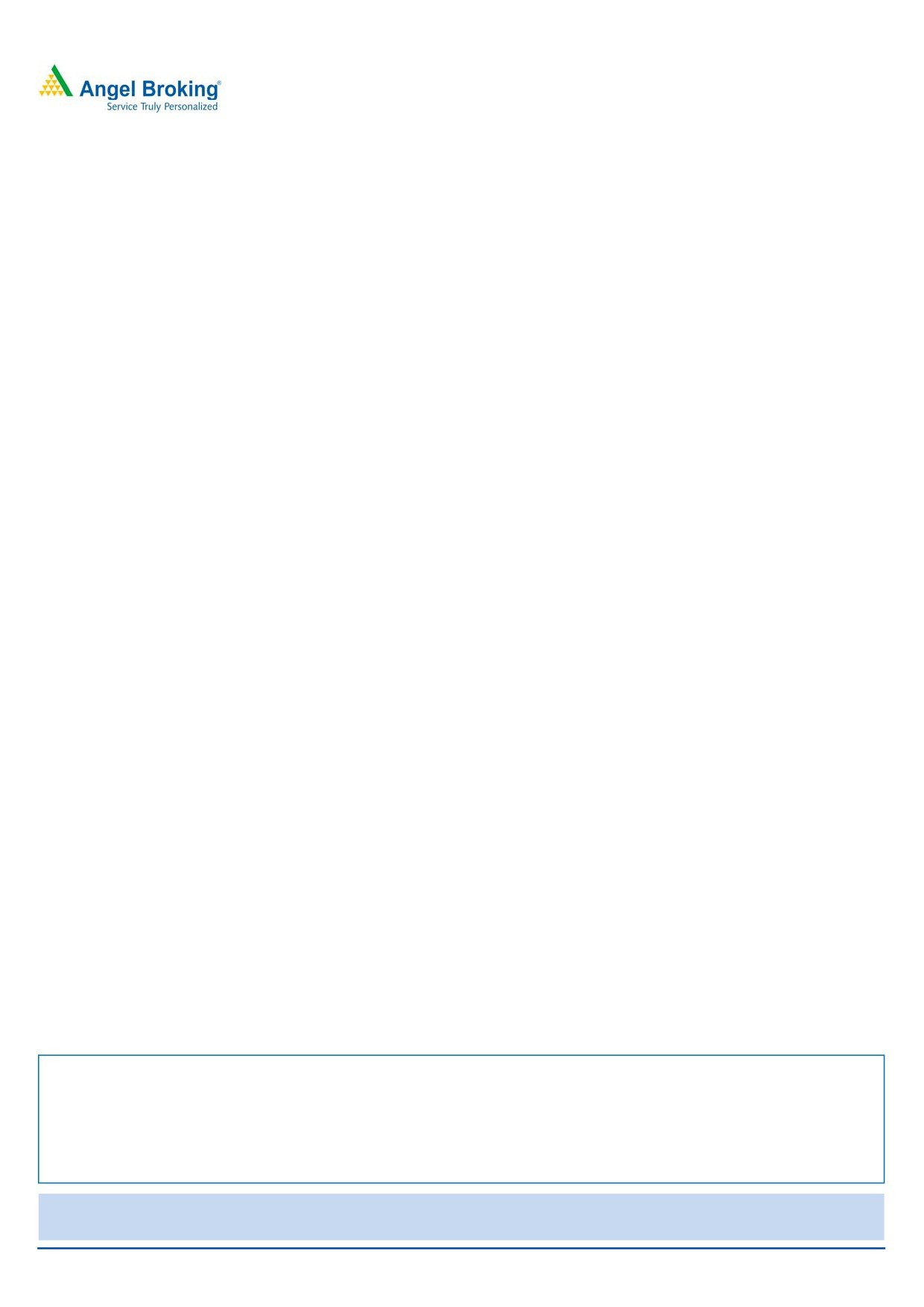

Exhibit 9: Significant increase in ad spend

8.0

7.0

7.0

6.0

5.0

3.7

4.0

3.0

2.0

2.0

1.2

1.0

0.0

FY2013

FY2014

FY2015

FY2016

Source: Company, Angel Research

Interest cost as a % of sale to decline 150bp over FY16-19

In 1HFY17, the company had total debt of `617cr of which `211cr was in form of

term loan. Management has indicated that it will fully repay the term loan in next

three years; we however have assumed `90cr repayment of term loan in our

forecast. This however would be offset by the incremental working capital loan due

to the growth in its EPC. The company however has seen improvement in its credit

rating which means company would be able to raise working capital loan at

competitive rate. The effect in our opinion would be drop in its interest cost as % to

net sales as rise in working capital loan would be offset by lower interest rate and

repayment of term loan. This would lead to improving profitability.

Exhibit 10: Debt/Equity ratio falling

2.0

1.9

1.9

1.8

1.6

1.5

1.4

1.4

1.2

1.2

1.0

1.0

0.9

0.8

0.6

0.4

0.2

0.0

FY2013

FY2014

FY2015

FY2016

FY2017E FY2018E FY2019E

Source: Company, Angel Research

December 30, 2016

6

KEI Industries | Initiating Coverage

Outlook and Valuation

We expect KEI to report net revenue CAGR of

~13% to ~`3,335cr over

FY2016-19E mainly due to (a) higher order book execution in EPC segment

(b) growth in EHV business and (c) higher B2C sales and (d) higher exports. On the

bottom-line front, we expect a CAGR of ~24% to `118cr over the same period on

the back strong revenue and lower interest cost. At the CMP of `124, the stock

trades at 8.1x its FY2019E EPS of `15.3. We initiate coverage on the stock with a

Buy recommendation and target price of `153 based on 10x FY2019E EPS,

indicating an upside of ~23% from the current levels.

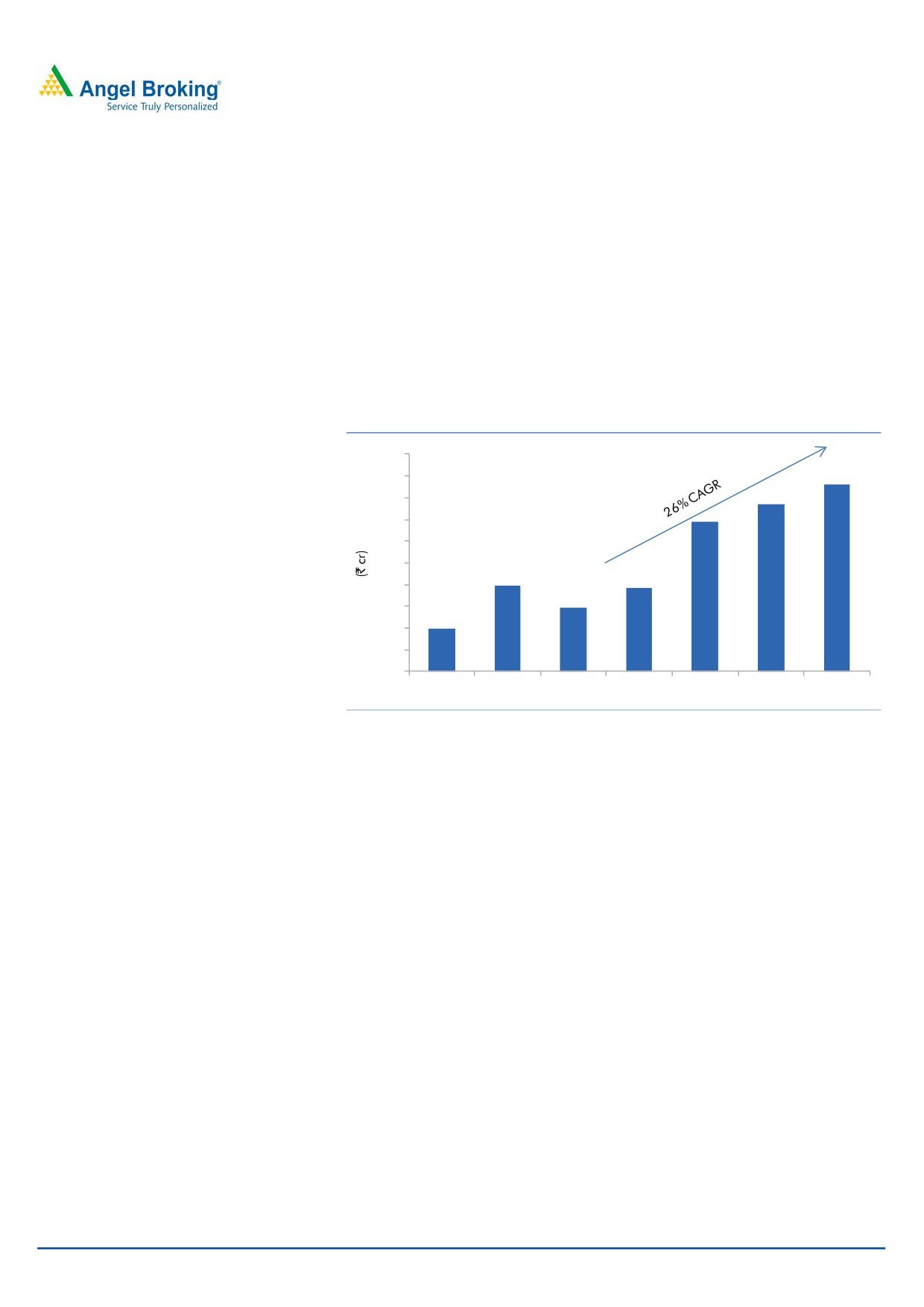

Exhibit 11: One year forward PE Chart

180

Share Price

3x

6x

9x

12x

15x

160

140

120

100

80

60

40

20

0

Source: Company, Angel Research

Downside risks to our estimates

KEI’s EPC segment contributes ~14% in the total revenue. This segment

primarily depends upon government spending and any delay in investment by

government may lead to reduction in order book and would impact its

revenue.

Any unfavourable change in the prices of commodities, forex and interest

rates, and delay in project execution can hurt its profitability.

December 30, 2016

7

KEI Industries | Initiating Coverage

Company Background

KEI Industries Limited (KEI) is a cable manufacturing company, engaged in

manufacture and supply of power and other industrial cables. The Company is

also engaged in Engineering, Procurement and Construction (EPC) business. It

operates through Cables and Turnkey Projects segments and has its manufacturing

facilities at Bhiwadi & Chopanki in Rajastahn and Silvassa in Dadra and Nagar

Haveli.

The cables segment comprises of a whole range of cables such as Extra High

Voltage (EHV), High tension (HT) and low tension (LT) power cables, control and

instrumentation cables, winding wires, flexible wires, and house and stainless steel

wires. Their products are supplied in various sectors like oil refineries, railways,

automobiles, cement, steel, fertilizers, textile and real estate sectors.

Exhibit 12: Revenue-break (Domestic vs Export)

Exhibit 13: Revenue -break up for FY2016

Turnkey

100

Projects, 14%

LT Power /

Stainless Steel

Rubber cable,

80

Wire, 4%

41%

60

88

87

87

87

94

93

92

HW, WW &

40

Flexible wire,

16%

20

12

13

13

13

6

7

8

0

EHV cable, 6%

HT Power

FY2013

FY2014

FY2015

FY2016

FY2017E FY2018E FY2019E

casble, 19%

Export

Domestic

Source: Company, Angel Research

Source: Company, Angel Research

December 30, 2016

8

KEI Industries | Initiating Coverage

Profit & Loss Statement

Y/E March (` cr)

FY2015

FY2016

FY2017E

FY2018E

FY2019E

Total operating income

2,031

2,326

2,574

2,921

3,335

% chg

25.5

14.5

10.7

13.5

14.2

Total Expenditure

1,838

2,083

2,306

2,629

3,001

Raw Material

1,477

1,615

1,796

2,051

2,354

Personnel

62

83

98

117

140

Others Expenses

299

386

412

462

507

EBITDA

193

242

268

292

333

% chg

26.0

25.6

10.5

9.1

14.2

(% of Net Sales)

9.5

10.4

10.4

10.0

10.0

Depreciation& Amortisation

25

25

29

30

32

EBIT

168

217

239

262

302

% chg

27.4

28.9

10.1

9.6

15.3

(% of Net Sales)

8.3

9.3

9.3

9.0

9.1

Interest & other Charges

120

127

128

131

132

Other Income

5

5

6

6

6

(% of PBT)

9.4

5.6

4.7

4.0

3.1

Share in profit of Associates

-

-

-

-

-

Recurring PBT

53

95

116

136

176

% chg

142.3

80.3

22.1

17.1

29.0

Tax

19

33

38

45

58

(% of PBT)

35.2

34.8

33.0

33.0

33.0

PAT (reported)

34

62

78

91

118

Extraordinary Items

2

-

-

-

-

ADJ. PAT

33

62

78

91

118

% chg

180.7

91.0

25.4

17.1

29.0

(% of Net Sales)

1.6

2.7

3.0

3.1

3.5

Basic EPS (`)

4.2

8.1

10.1

11.8

15.3

Fully Diluted EPS (`)

4.2

8.1

10.1

11.8

15.3

% chg

180.7

91.0

25.4

17.1

29.0

December 30, 2016

9

KEI Industries | Initiating Coverage

Balance Sheet

Y/E March (` cr)

FY2015

FY2016

FY2017E FY2018E FY2019E

SOURCES OF FUNDS

Equity Share Capital

15

15

15

15

15

Reserves& Surplus

288

351

424

509

618

Shareholders Funds

304

367

440

525

633

Minority Interest

-

-

-

-

-

Total Loans

453

498

547

545

552

Deferred Tax Liability

39

40

40

40

40

Total Liabilities

796

905

1,027

1,110

1,225

APPLICATION OF FUNDS

Gross Block

445

500

544

559

589

Less: Acc. Depreciation

147

172

200

231

262

Net Block

298

328

344

328

327

Capital Work-in-Progress

4

29

-

-

-

Investments

3

3

3

3

3

Current Assets

1,036

1,127

1,280

1,481

1,708

Inventories

440

422

479

552

640

Sundry Debtors

480

567

635

736

850

Cash

5

6

12

17

19

Loans & Advances

106

109

129

146

167

Other Assets

5

22

26

29

33

Current liabilities

562

586

604

706

817

Net Current Assets

474

541

677

774

891

Deferred Tax Asset

16

4

4

4

4

Mis. Exp. not written off

-

-

-

-

-

Total Assets

796

905

1,027

1,110

1,225

December 30, 2016

10

KEI Industries | Initiating Coverage

Cash flow Statement

Y/E March (` cr)

FY2015

FY2016

FY2017E FY2018E FY2019E

Profit before tax

53

95

116

136

176

Depreciation

25

25

29

30

32

Change in Working Capital

5

(51)

(130)

(93)

(115)

Interest / Dividend (Net)

120

127

128

131

132

Direct taxes paid

(9)

(20)

(38)

(45)

(58)

Others

5

8

0

0

0

Cash Flow from Operations

198

185

105

160

166

(Inc.)/ Dec. in Fixed Assets

(17)

(98)

(44)

(15)

(30)

(Inc.)/ Dec. in Investments

0

0

29

0

0

Cash Flow from Investing

(17)

(98)

(15)

(15)

(30)

Issue of Equity

0

0

0

0

0

Inc./(Dec.) in loans

44

92

49

(2)

7

Dividend Paid (Incl. Tax)

(2)

(3)

(5)

(6)

(9)

Interest / Dividend (Net)

(224)

(175)

(128)

(131)

(132)

Cash Flow from Financing

(181)

(87)

(84)

(140)

(134)

Inc./(Dec.) in Cash

0

1

6

5

2

Opening Cash balances

5

5

6

12

17

Closing Cash balances

5

6

12

17

19

December 30, 2016

11

KEI Industries | Initiating Coverage

Key ratios

Y/E March

FY2015

FY2016

FY2017E FY2018E FY2019E

Valuation Ratio (x)

P/E (on FDEPS)

29.4

15.4

12.3

10.5

8.1

P/CEPS

16.3

10.9

9.0

7.9

6.4

P/BV

3.2

2.6

2.2

1.8

1.5

Dividend yield (%)

0.3

0.4

0.5

0.7

1.0

EV/Sales

0.7

0.6

0.6

0.5

0.4

EV/EBITDA

7.3

6.0

5.6

5.1

4.5

EV / Total Assets

1.8

1.6

1.5

1.3

1.2

Per Share Data (`)

EPS (Basic)

4.2

8.1

10.1

11.8

15.3

EPS (fully diluted)

4.2

8.1

10.1

11.8

15.3

Cash EPS

7.6

11.3

13.8

15.7

19.3

DPS

0.4

0.5

0.6

0.8

1.2

Book Value

39.3

47.5

56.9

67.9

82.0

Returns (%)

ROCE

22.2

25.1

24.2

24.5

25.5

Angel ROIC (Pre-tax)

22.5

25.4

24.6

24.9

26.0

ROE

10.7

17.0

17.7

17.4

18.6

Turnover ratios (x)

Asset Turnover (Gross Block)

4.6

4.7

4.7

5.2

5.7

Inventory / Sales (days)

79

66

68

69

70

Receivables (days)

86

89

90

92

93

Payables (days)

40

41

41

41

41

WC cycle (ex-cash) (days)

126

115

117

120

122

December 30, 2016

12

KEI Industries | Initiating Coverage

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

KEI Industries

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

December 30, 2016

13